We made something very clear in our last article, Why You Should Shop for Healthcare,

- Your “insurance” company is not the payer.

- Your “employer” is not the payer.

- You are.

Forget the industry lingo. It is meant to fool you

YOU. ARE. THE. PAYER.

…proceed accordingly.

Money comes out of your salary to fund your healthcare expenses.

Your employer is a middleman, and your insurance company is yet another. This means you MUST SHOP to get the best quality and value. It is ultimately your money and the savings will add up faster for you.

In the upcoming series of articles I will cover five ways to shop and save. In this first article we address researching. In theory it is simple. You can research healthcare the same way you would a vacation or car repair: you go online and you start hunting.

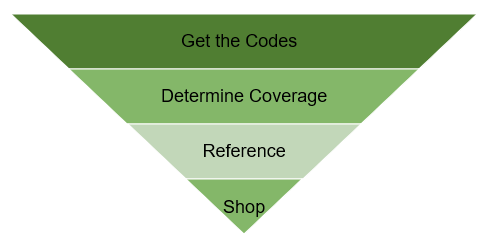

Here’s the gist of it:

- Find out what the codes are and research the codes

- Find out what is covered by your insurance

- Get an up-front estimate in writing

- Compare that estimate to prices online

Objective: educate yourself on what the procedure is and how it is billed.

Consider this analogy: shopping for a new alternator for your car. It’s always better to go into the mechanic asking for a price when you know exactly what’s wrong with your car. Saying “it won’t start” won’t get you nearly as far as “I had roadside assistance check the battery and they said I need a new alternator”. Now you’re ready to get a price.

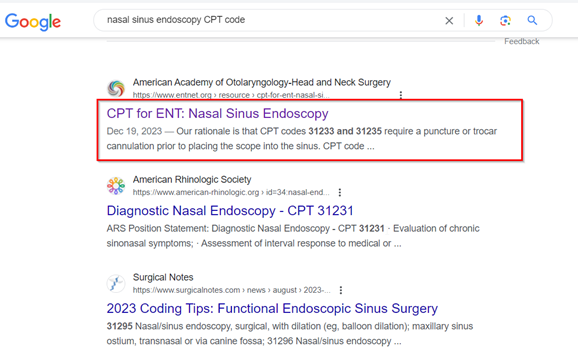

If you can use the internet, you can research CPT codes. In a previous article we looked at getting a price from the local hospital for a nasal/sinus endoscopy. So let’s continue on that quest and research the codes. Assume a general practitioner has referred you to an ear nose and throat specialist for this procedure. A nasal endoscopy is a detailed examination of internal nasal anatomy and helps determine cause of congestion/obstruction.

Voila, we have codes 31233 and 31235. Someone is going to stick a “looking glass” up your nose and see what’s going on up there.

2. Find out what is covered by your insurance

Objective: find out how much your insurance will cover.

So now we know what we need, a 31233 or a 31235, now lets figure out how much our insurance will kick in. Will they cover all or part of this procedure? You have three general options for this.

First you will want to understand where you are in your deductible cycle, then do one or more of the following:

- Look it up in your plan’s Summary of Benefits and Coverage, or

- Look on your plan’s online portal for a cost estimator tool

- Call them!

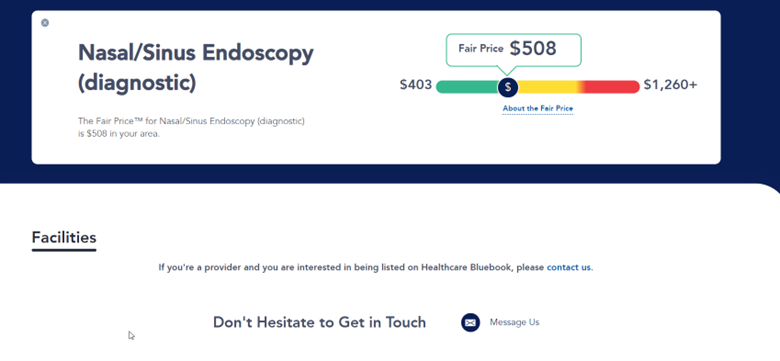

3. Get a Reference Price

Objective: know if a certain provider is over-charging.

This is the true magic of the digital age and a nightmare for greedy providers: online price guides for health services. According to Healthcare Bluebook – free account required – I found that it should cost about $508 in my area

Source: Healthcarebluebook.com on 5/8/2024

Other places to find reference prices include:

4. Shop and Save

Objective: get the best service for the best price.

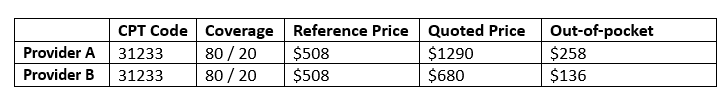

So now you know what you need, how much insurance will factor in, and a general idea what it should cost. Now it’s time to get some prices.

They will try and make this difficult, but hold their feet to the fire. They are required by law. Ask for the cash price as well as the contracted rate with your insurance. You’d be surprised at how often the cash price is less. Another thing to keep in mind is that the Transparency in Cover Rule (TiC) went into effect in 2022. As per this rule, hospitals are required to post their prices for 300 of the most common procedures. If it’s a hospital, according to TiC, you are supposed to be able to look up the price online via the provider’s website.

In this example both providers were a little on the high side compared to the reference price. But let’s assume that it took me an hour to go through the four steps: research the code, determine coverage, get a reference price, and contact two providers. In that hour I saved $122, which for most people ain’t bad for an hour of work. Plus, if more people did this type of shopping, Provider A, who is greedy, would start losing business and would have to start lowering prices.

Yes, medicine is a business. Providers have a P&L to manage just like anyone else. If we as consumers start to treat providers like any other business and SHOP, then medical providers will have to deliver better value – better prices and better service – in order to survive, otherwise their competitors will.